Back

The Complete Vermont Airbnb Host Lodging Tax Guide: Airbnb Vermont Occupancy Tax Breakdown

Written by:

Jeremy Werden

April 24, 2025

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

Vermont’s scenic charm and thriving tourism make it a popular destination for short-term rentals. However, hosting on platforms like Airbnb in the Green Mountain State comes with specific tax obligations. From the state’s Meals and Rooms Tax to local option taxes and a recently introduced 3% short-term rental surcharge, understanding these requirements is crucial for compliance and financial planning. This guide will break down Vermont’s lodging tax requirements, informing hosts of their obligations and ensuring that their hosting experience remains both enjoyable and lawful.

State-wide Lodging and Occupancy Taxes in Vermont

Starting January 2025, Vermont short-term rentals are subject to the state Meals & Rooms Tax and a new short-term rental surcharge. The Meals and Rooms Tax applies a 9% lodging (rooms) tax on all accommodations. In addition, the state has created a 3% short-term rental surcharge on stays booked on Aug 1, 2024, or later. Overall, every Airbnb/VRBO booking in Vermont faces a 12% state tax (9% + 3%) before any local taxes.

Vermont law requires hosts or hosting platforms, depending on the location, to collect these taxes from guests and remit them on the Meals & Rooms Tax return.

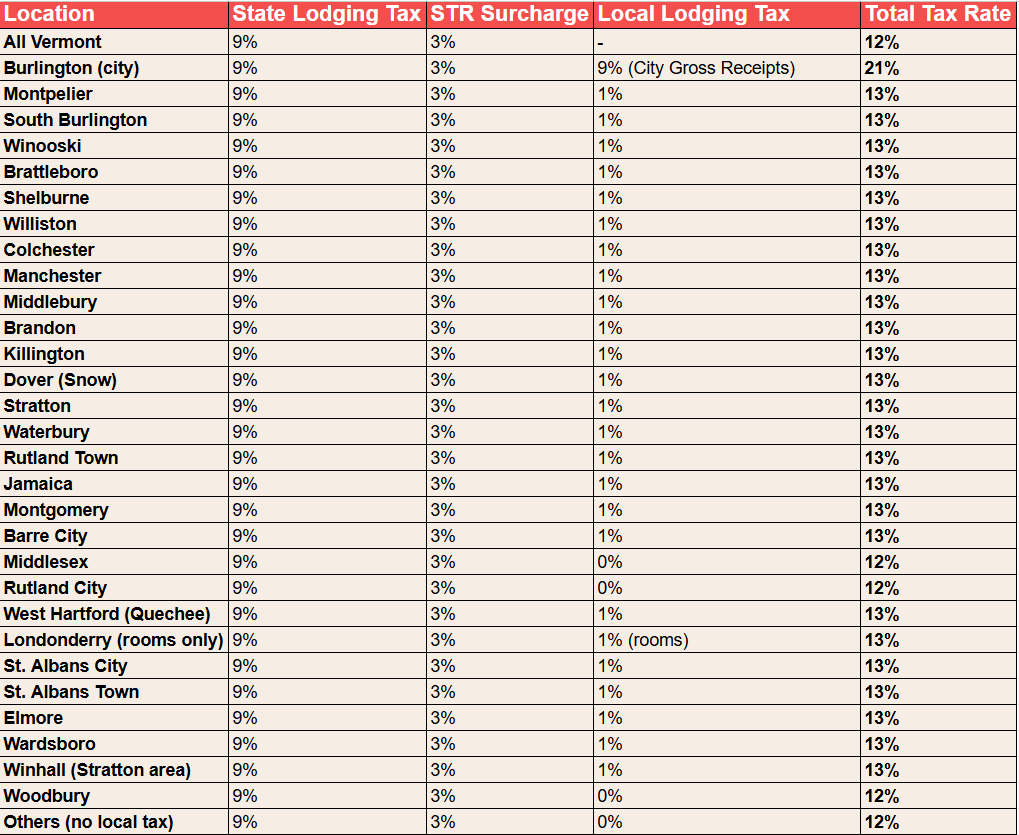

Additionally, some Vermont municipalities add a 1% local lodging tax on top of the state rates. This is called a local “option” tax. For example, Montpelier, Brattleboro, and South Burlington, among others, voted to add 1% to the rooms tax. In those areas, the total tax on a short stay is 13% (9% state + 3% surcharge + 1% local).

Does Airbnb or VRBO Collect and Remit Taxes in Vermont?

Vermont law requires platforms like Airbnb and VRBO to collect and remit these taxes on the hosts’ behalf. Any online booking platform must register with Vermont’s Department of Taxes and automatically charge the State Meals & Rooms Tax (9%), the short-term rental surcharge (3%), and any applicable 1% local lodging tax.

Most short-term hosts will have their platform handle collection, but any independent rentals must be registered with the Vermont Department of Taxes and collect the 9% state tax, 3% surcharge, and any local tax themselves.

So, if you list your home on Airbnb, Airbnb will collect the taxes from the guests and send them to the Vermont government. However, you are still required to report the income on your personal tax return, but you don’t have to handle the tax filings for platform-booked stays. However, it’s always best to contact your local authorities to confirm tax collection.

County-Specific Local Tax Requirements

As mentioned, many Vermont cities and towns impose an extra 1% local lodging tax on short-term stays outside of the state taxes. These local taxes are typically voter-approved “local option taxes” used for city services or tourism promotion. Some towns have only a general sales tax, but if a town has a local rooms tax, hosts must add 1% on lodging charges.

Most areas follow a standard breakdown of a 9% Meals & Rooms Tax, a 3% short-term rental surcharge, and a 1% local lodging tax for a total of 13%. However, there are a couple that either don’t impose a local lodging tax or have their own local tax.

Here are a couple examples of computations to help you visualize the breakdown.

Example Calculation for a Property in Burlington City

Burlington City is also the only city that doesn’t follow the Local Lodging Tax. Instead, it imposes its own City Gross Receipts tax at 9%.

A 4-night stay at $175 per night:

- Total nightly Rate: $175 x 4 = $700

- Cleaning Fee: $90

- Total Listing Price for a 4-night stay: ($175 × 4) + $90 = $790

- State Lodging Tax (9%): $790 x 0.09 = $71.1

- STR Surcharge (3%): $790 x 0.03 = $23.7

- City Gross Receipts (9%): $790 x 0.09 = $26.1

- Total Tax Collected (21%): $165.90

- Total Guest Payment: $790 + $165.90 = $955.90

Example Calculation for a Property in Colchester (and Other Municipalities with 1% Local Lodging Tax)

A 2-night stay at $155 per night:

- Total nightly Rate: $155 x 2 = $310

- Cleaning Fee: $60

- Total Listing Price for a 2-night stay: ($155 × 2) + $60 = $370

- State Lodging Tax (9%): $370 x 0.09 = $33.3

- STR Surcharge (3%): $370 x 0.03 = $11.1

- Local Lodging Tax (1%): $370 x 0.01 = $3.7

- Total Tax Collected: $48.10

- Total Guest Payment: $370 + $48.10 = $418.10

Wrapping Things Up

While these taxes are generally automatically collected by your respective booking platform, knowing and understanding them is still an essential part of your hosting journey. Staying informed and proactive not only safeguards your business but also contributes positively to Vermont’s vibrant tourism industry.

These tax ranges are meant for general information purposes. Local counties and even cities can have more specific rates that only apply to them. For this reason, we still highly recommend checking out the local STR regulations in your area or contacting local officials for more information.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.