Back

The Complete South Dakota Airbnb Host Lodging Tax Guide: Airbnb South Dakota Occupancy Tax Breakdown

Written by:

Jeremy Werden

April 23, 2025

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

Navigating your tax obligations can be overwhelming when you're just starting your Airbnb journey in South Dakota. Countless property owners rush into listing their homes without fully grasping the tax implications, only to face unexpected bills and compliance headaches later. This detailed guide unpacks all the lodging and occupancy taxes you'll encounter as a South Dakota short-term rental operator, providing clear examples and practical advice to help you maintain compliance while maximizing your rental income.

State-wide Lodging and Occupancy Taxes in South Dakota

South Dakota imposes several taxes on short-term rentals, which are defined as accommodations rented for less than 28 consecutive days. These taxes are:

- State Sales Tax: 4.5% of the total listing price, including cleaning fees and guest fees, for reservations 27 nights or shorter. This tax applies to all short-term rentals in South Dakota.

- Tourism Tax: 1.5% of the gross receipts from short-term rentals. This tax applies to hotels, lodging establishments, campgrounds, and other accommodations rented to transient guests (those staying fewer than 28 consecutive days).

Certain rentals qualify for tax exemptions in South Dakota. Properties rented for 10 or fewer days annually are classified as "casual or occasional" and exempt from taxation. Additionally, any rental agreement lasting 28 consecutive days or longer isn't subject to lodging and occupancy taxes.

These exemptions provide flexibility for property owners who only rent occasionally during special events or who prefer longer-term arrangements. Understanding these distinctions can help you structure your rental strategy to potentially minimize tax obligations while remaining fully compliant with state regulations.

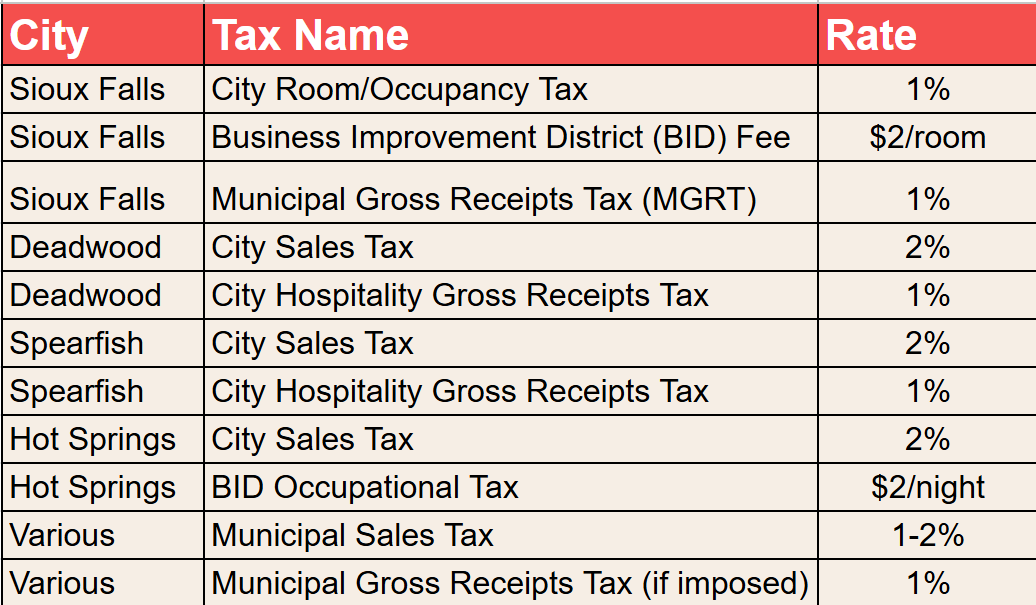

City and County-Specific Tax Requirements

Rapid City

The City of Rapid City requires all short-term rentals operating within its jurisdiction to obtain a permit. This requirement is formalized under Section 17.50.340 of the Rapid City Municipal Code. As part of the permit application process, short-term rental operators are obligated to provide documentation that demonstrates their licensure and registration with relevant state agencies, including both the Department of Health and the Department of Revenue.

Deadwood

Deadwood levies a 2% City Sales Tax and a 1% City Hospitality Gross Receipts Tax on lodging accommodations. Short-term rentals like Specialty Resorts and Vacation Home Establishments require a Conditional Use Permit, proof of state excise tax, and a lodging license. Generally, transient commercial use of residential property is prohibited, except for a 14-day period during August's Sturgis Motorcycle Rally.

Spearfish

The City of Spearfish imposes a 2% City Sales Tax. Spearfish also levies a 1% City Hospitality Gross Receipts Tax on the gross receipts generated from lodging accommodations within the municipality.

Hot Springs

The City of Hot Springs levies a 2% City Sales Tax. Additionally, Hot Springs imposes an occupational tax of $2 per night on transient guests who stay in hotels, motels, or other lodging establishments located within the city's designated Business Improvement District (BID).

Sioux Falls

In addition to the standard state sales tax and potential MGRT, the City of Sioux Falls imposes a 1% city room/occupancy tax. Furthermore, the city levies a $2 per room Business Improvement District (BID) fee. Sioux Falls also has a 1% Municipal Gross Receipts Tax (MGRT) that is specifically applied to short-term rentals. Since January 1, 2024, Sioux Falls has mandated that all property owners and managers of both long-term and short-term residential rental units must obtain a permit from the city.

A fee of $50 per address will be applicable for this permit after July 1, 2024. Short-term rental operators in Sioux Falls are also required to hold a state sales tax license and a lodging license issued by the South Dakota Department of Health.

Example Calculation for a Property in Sioux Falls

A 3-night stay at a 3-bedroom property at $120 per night:

- Total nightly Rate: $120 x 3 = $360

- Cleaning Fee: $100

- Guest Fee: $35

- Total Listing Price for a 3-night stay: ($120 × 3) + $100 + $35 = $495

- State Sales Tax (4.5%): $495 × 0.045 = $22.275

- Tourism Tax (1.5%): $495 × 0.015 = $7.425

- Municipal Gross Receipts Tax (MGRT) 1%: $495 × 0.01 = $4.95

- City Room/ Occupancy Tax (1%): $495 × 0.01 = $4.95

- Business Improvement District (BID) ($2/room/night): $2 x 3 rooms x 3 nights = $18

- Total Taxes: $57.60

- Total Guest Payment: $495 + $57.60 = $552.6

Wrapping Things Up

By properly managing your tax obligations, you'll not only avoid potential penalties but also contribute to the tourism infrastructure that makes South Dakota an attractive destination for your future guests.

These tax ranges are just general estimates based on the average rates per state. Local counties and even cities can have more specific rates that only apply to them. For this reason, we still highly recommend checking out the local STR regulations in your area or contacting local officials for more information.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.