Back

The Complete South Carolina Airbnb Host Lodging Tax Guide: Airbnb South Carolina Occupancy Tax Breakdown

Written by:

Jeremy Werden

April 23, 2025

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

If you're hosting on Airbnb in South Carolina, understanding lodging and occupancy taxes is essential. Our guide helps you understand local tax requirements, assisting you in staying compliant and running your short-term rental smoothly.

State-wide Lodging and Occupancy Taxes in South Carolina

All short-term rental hosts operating in South Carolina are subject to certain state-level taxes that must be collected from guests and remitted to the appropriate authorities:

State Sales and Accommodations Taxes

- State Sales Tax: 5.0% of the listing price, including any cleaning fees and guest fees

- State Accommodations Tax: 2.0% of the listing price, including any cleaning fees and guest fees

- Total State-level Tax: 7.0% of the listing price

These taxes apply to rentals of accommodations for less than 90 consecutive days. The state accommodations tax is mandatory and applies to "rental or charges for any rooms, campground spaces, lodgings, or sleeping accommodations furnished to transients by any hotel, inn, tourist court, tourist camp, motel, campground, residence, or any place in which rooms, lodgings, or sleeping accommodations are furnished to transients for a consideration," as indicated in the Municipal Association of South Carolina (MASC) resource.

However, you may be exempt from some or all of these taxes if:

- Your rental period is 90 continuous days or longer

- Your facility consists of less than six sleeping rooms on the same premises, which you use as your place of abode

- You rent out your unit for less than 15 days during the taxable year

The good news is that Airbnb and some other platforms automatically collect and remit state-level taxes on your behalf in some places. Both Airbnb and VRBO automatically collect and remit the 7% state taxes (5% State Sales Tax + 2% State Accommodations Tax). However, it's still important to be aware and keep up with these taxes to ensure that they are actually being remitted and that you are free from tax remittance obligations.

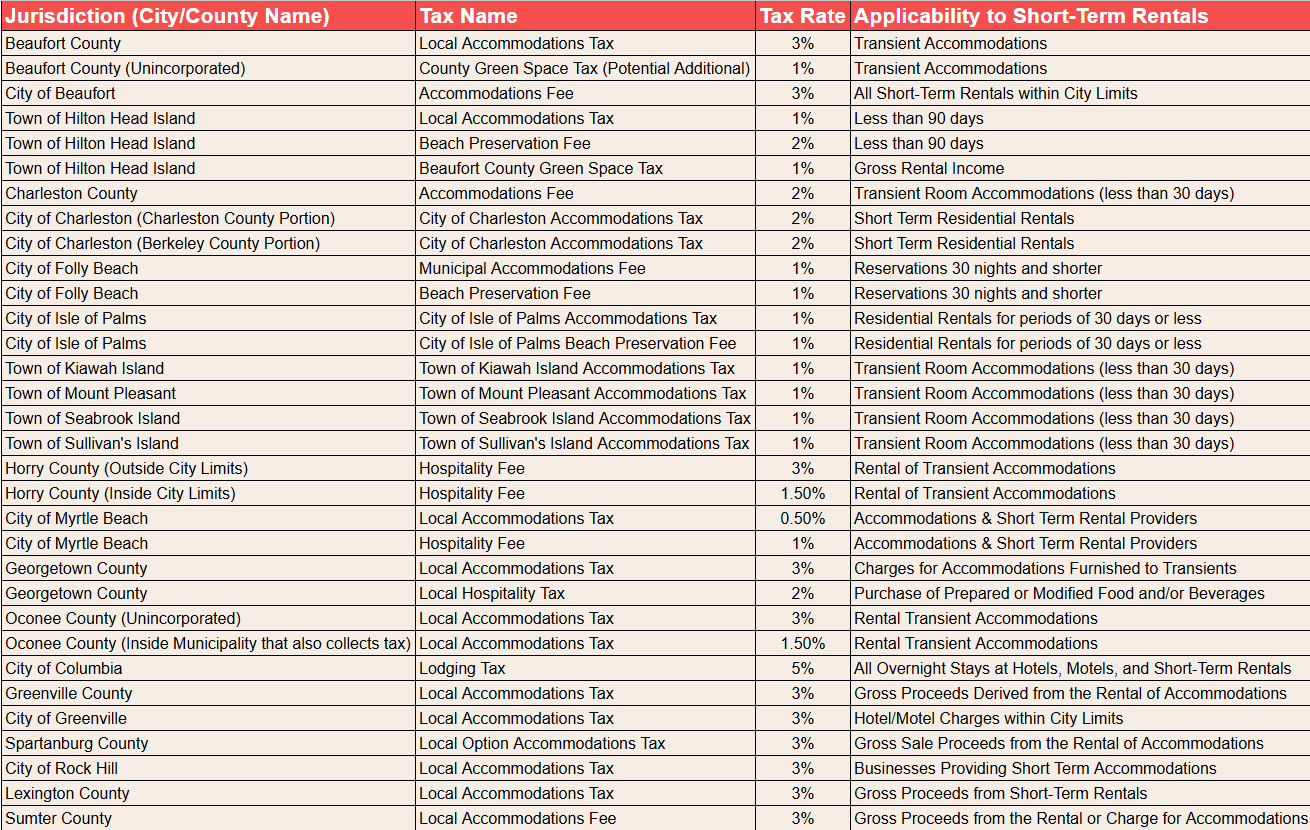

City and County-Specific Tax Requirements

Here are the counties and cities with their own imposed taxes applicable to short-term rentals. These are added on top of the state-level taxes.

Beaufort County Local Lodging and Occupancy Taxes

Imposes a 3% local accommodations tax countywide on transient stays. Properties in unincorporated areas may face an additional 1% County Green Space tax, potentially raising the total to 4%. This demonstrates the county's commitment to funding tourism activities while supporting environmental preservation in specific regions.

City of Beaufort

Charges its own 3% accommodations fee within city limits, collected by the City Business License Office. This additional city-level tax creates a dedicated revenue stream for local tourism initiatives and infrastructure, operating independently from county-wide funding efforts.

Town of Bluffton

Subject to Beaufort County's standard 3% Accommodations Tax plus the potential 1% Green Space tax for all short-term rentals within town boundaries.

Town of Hilton Head Island

Levies a 1% local accommodations tax and a 2% Beach Preservation Fee on rentals under 90 days. Combined with state taxes and the County Green Space Tax, total taxation reaches 11% of gross rental income, highlighting the island's focus on beach maintenance.

Town of Port Royal

All short-term rentals face Beaufort County's standard 3% Accommodations Tax plus the potential 1% Green Space tax.

Example Calculation for a Property in Beaufort County

A 5-night stay at $175 per night:

- Total nightly Rate: $175 x 5 = $875

- Cleaning Fee: $60

- Guest Fee: $15

- Total Listing Price for a 5-night stay: ($175 × 5) + $60 + $15 = $950

- State Sales Tax (5%): $950 × 0.05 = $47.50 (collected by Airbnb)

- State Accommodations Tax (2%): $950 × 0.02 = $19.00 (collected by Airbnb)

- Beaufort County Accommodations Tax (3%): $950 × 0.03 = $28.50 (host must collect and remit)

- Total Taxes: $95.00

- Total Guest Payment: $950 + $95.00 = $1,045.00

Charleston County

Established a 2% Accommodations Fee applying to transient room rentals under thirty days. This fee functions as a local accommodations tax specifically targeting the short-term rental market throughout the county.

City of Charleston

Properties in Charleston County portion face an additional 2% City Accommodations Tax, totaling 14% when combined with other taxes. The other taxes include a Local Option Sales Tax (1%), County Transportation Tax (1%), and a School District/ Education Tax (1%).

Properties in Berkeley County portion also pay 2% City tax but total only 12%, reflecting the complexities of cross-county municipal boundaries.

City of Folly Beach

Collects a 1% Municipal Accommodations Fee and 1% Beach Preservation Fee on rentals of 30 nights or less. These add to the 2% Charleston County Accommodations Tax, generating revenue for both tourism and beach maintenance.

City of Isle of Palms

Imposes a 1% City Accommodations Tax and 1% Beach Preservation Fee on rentals of 30 days or less, supplementing the Charleston County Accommodations Tax.

Town of Kiawah Island

Charges a 1% Town Accommodations Tax in addition to the 2% Charleston County Accommodations Tax.

Town of Mount Pleasant

Levies a 1% Town Accommodations Tax on top of the 2% Charleston County Accommodations Tax.

Town of Seabrook Island

Implements a 1% Town Accommodations Tax alongside the 2% Charleston County Accommodations Tax.

Town of Sullivan's Island

Collects a 1% Town Accommodations Tax plus the 2% Charleston County Accommodations Tax.

Example Calculation for a Property in the City of Charleston within Charleston County

A 4-night stay at $200 per night:

- Total nightly Rate: $200 x 4 = $800

- Cleaning Fee: $75

- Guest Fee: $25

- Total Listing Price for a 4-night stay: ($200 × 4) + $75 + $25 = $900

- State Sales Tax (5%): $900 × 0.05 = $45.00 (collected by Airbnb)

- State Accommodations Tax (2%): $900 × 0.02 = $18.00 (collected by Airbnb)

- Charleston County Accommodations Tax (2%): $900 × 0.02 = $18.00 (host must collect and remit)

- City of Charleston Accommodations Tax (2%): $900 × 0.02 = $18.00 (host must collect and remit)

- Local Option Sales Tax (1%): $900 × 0.01 = $9.00

- County Transportation Tax (1%): $900 × 0.01 = $9.00

- School District/ Education Tax (1%): $900 × 0.01 = $9.00

- Total Taxes: $126.00

- Total Guest Payment: $900 + $126.00 = $1026.00

Georgetown County

Imposes a 3% local accommodations tax on transient lodging charges. Additionally levies a 2% local hospitality tax on prepared food and beverages within its jurisdiction.

Example Calculation for a Property in Georgetown County

A 6-night stay at $125 per night:

- Total nightly Rate: $125 x 6 = $750

- Cleaning Fee: $80

- Guest Fee: $20

- Total Listing Price for a 6-night stay: ($125 × 6) + $80 + $20 = $850

- State Sales Tax (5%): $850 × 0.05 = $42.5

- State Accommodations Tax (2%): $850 × 0.02 = $16.50

- Georgetown County Accommodations Tax (3%): $850 × 0.03 = $25.50

- Total Taxes: $84.50

- Total Guest Payment: $850 + $84.50 = $934.50

Oconee County

Applies a variable local accommodations tax: 3% for properties in unincorporated areas and 1.5% for those inside municipalities with their own accommodations tax. Requires all short-term rental properties to register with the county government.

Example Calculation for a Property in Unincorporated Oconee County

A 3-night stay at $125 per night:

- Total nightly Rate: $125 x 3 = $375

- Cleaning Fee: $40

- Guest Fee: $10

- Total Listing Price for a 3-night stay: ($125 × 3) + $40 + $10 = $425

- State Sales Tax (5%): $425 × 0.05 = $21.25 (collected by Airbnb)

- State Accommodations Tax (2%): $425 × 0.02 = $8.50 (collected by Airbnb)

- Oconee County Accommodations Tax (3%): $425 × 0.03 = $12.75 (host must collect and remit)

- Total Taxes: $42.50

- Total Guest Payment: $425 + $42.50 = $467.50

Greenville County

Charges a 3% local accommodations tax on gross proceeds from rental accommodations countywide.

City of Greenville

Collects an additional 3% local accommodations tax within city limits. Zoning regulations restrict short-term rentals under 30 days to non-residential districts where "General Lodging" is permitted.

Example Calculation for a Property in The City of Greenville

A 2-night stay at $150 per night:

- Total nightly Rate: $150 x 2 = $300

- Cleaning Fee: $50

- Guest Fee: $20

- Total Listing Price for a 2-night stay: ($150 × 2) + $50 + $20 = $370

- State Sales Tax (5%): $370 × 0.05 = $18.50

- State Accommodations Tax (2%): $370 × 0.02 = $7.40

- Greenville County Accommodations Tax (3%): $370 × 0.03 = $11.1

- Greenville City local Accommodations Tax (3%): $370 × 0.03 = $11.1

- Total Taxes: $48.10

- Total Guest Payment: $370 + $48.10 = $418.10

Spartanburg County

Implements a 3% Local Option Accommodations Tax on gross rental proceeds throughout the county, including all municipalities within its boundaries.

Example Calculation for a Property in Spartanburg County

A 2-night stay at $175 per night:

- Total nightly Rate: $175 x 2 = $350

- Cleaning Fee: $70

- Guest Fee: $25

- Total Listing Price for a 2-night stay: ($175 × 2) + $70 + $25 = $445

- State Sales Tax (5%): $445 × 0.05 = $22.25

- State Accommodations Tax (2%): $445 × 0.02 = $8.90

- Spartanburg County Accommodations Tax (3%): $445 × 0.03 = $13.35

- Total Taxes: $44.50

- Total Guest Payment: $445 + $45.50 = $489.50

Lexington County

Imposes a 3% local accommodations tax on gross proceeds from short-term rentals in unincorporated areas. Municipalities like Batesburg-Leesville, Cayce, Lexington, West Columbia, and Irmo may charge additional local sales and hospitality taxes.

Sumter County

Charges a 3% local accommodations fee on gross rental proceeds. While the City of Sumter lacks specific short-term rental regulations, it requires Airbnb hosts and other operators to obtain a local business license and pay all applicable taxes.

City of Rock Hill

Requires a 3% Accommodations Tax for short-term rental businesses, due monthly by the 20th. Zoning regulations permit short-term rentals exclusively in commercial zones.

City of Columbia

Imposes a 5% lodging tax on all overnight stays at hotels, motels, and short-term rentals within city limits. This tax applies to total gross receipts across all booking platforms combined.

Example Calculation for a Property in the City of Columbia

A 5-night stay at $120 per night:

- Total nightly Rate: $120 x 5 = $600

- Cleaning Fee: $100

- Guest Fee: $35

- Total Listing Price for a 5-night stay: ($175 × 5) + $100 + $35 = $735

- State Sales Tax (5%): $735 × 0.05 = $36.50

- State Accommodations Tax (2%): $735 × 0.02 = $14.7

- City of Columbia Lodging Tax (5%): $735 × 0.05 = $36.50

- Total Taxes: $88.20

- Total Guest Payment: $735 + $88.20 = $823.2

Wrapping Things Up

Managing lodging and occupancy taxes is a critical aspect of running a successful and compliant short-term rental business in South Carolina. While state-level taxes are generally collected and remitted by major platforms like Airbnb and VRBO, hosts remain responsible for local county and municipal taxes in most cases.

Remember that tax rates and regulations can change, so it's always wise to verify current rates with your local tax authorities. Additionally, many jurisdictions require business licenses and permits in addition to tax registration.

These tax ranges are just general estimates based on the average rates per state. Local counties and even cities can have more specific rates that only apply to them. For this reason, we still highly recommend checking out the local STR regulations in your area or contacting local officials for more information.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.