Back

The Complete North Carolina STR Lodging Tax Guide: Airbnb and VRBO North Carolina Occupancy Tax Breakdown

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

North Carolina is a fantastic place to host on Airbnb. It’s filled with bustling cities, beach towns, and mountain getaways, providing a perfect mix of travelers. If you’re a new or aspiring Airbnb host in the Tar Heel State, it’s important to understand the taxes that apply to short-term rentals. Understanding your tax obligations is crucial to operating legally and profitably. Our guide breaks down the lodging and occupancy taxes you’ll need to collect and remit as a short-term rental host in North Carolina.

North Carolina-Wide Lodging Tax Requirements for Airbnb Hosts

In North Carolina, you’ll encounter statewide sales taxes and local occupancy (lodging) taxes on Airbnb stays. The State Sales Tax is a fixed 4.75%. However, there are specific counties and cities that impose additional local Sales Taxes that can bring the total up to 7.5%.

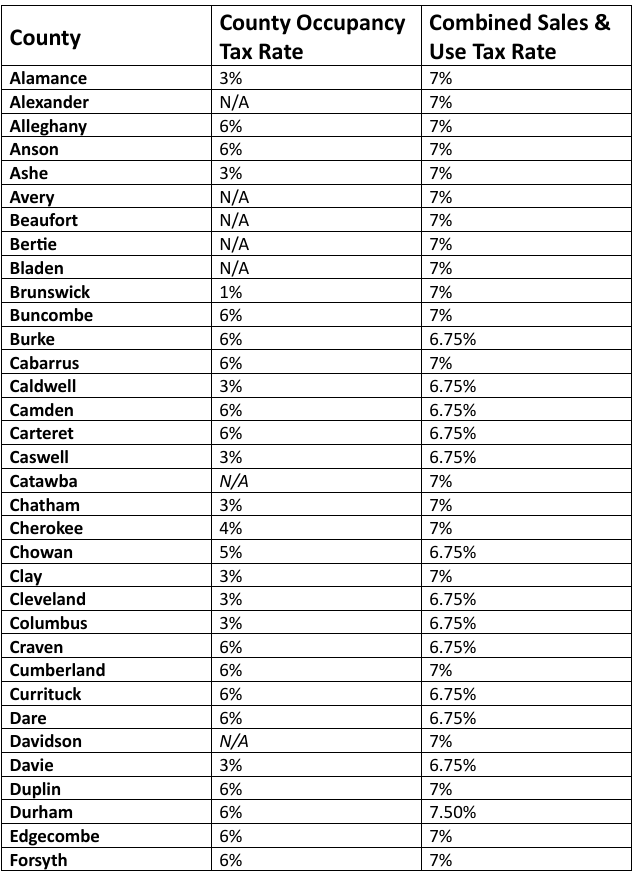

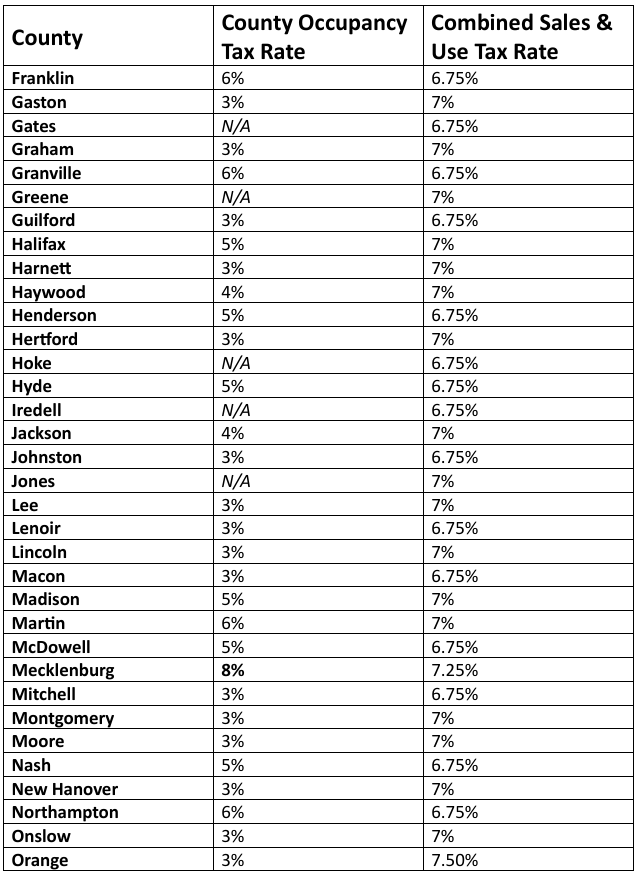

County-Wide Occupancy Tax Requirements in North Carolina

There are plenty of counties in North Carolina that impose local sales taxes, along with occupancy taxes ranging from 0% to 8%. Knowing the specific taxes that apply to you are crucial as a host. It allows you to adjust your pricing if necessary or let the guests shoulder the taxes. Here’s a complete list of all of the local combined Sales Taxes and Local imposed occupancy taxes for all counties in North Carolina.

Example North Carolina Tax Calculation Breakdown:

We’ll use Mecklenburg County as an example. Mecklenburg County is the only county that has an 8% occupancy tax. 8% is also the highest out of all counties within North Carolina. Additionally, Mecklenburg also imposes a 2% local sales tax, along with a 0.5% public transportation tax, bringing the total sales tax up to 7.25% (4.75% NC, 2% Mecklenburg County, and 0.5% Public Transportation Tax).

Example: A 5-night stay at $120 per night and a $80 cleaning fee.

- Total Nightly Revenue: $600

- Total Reservation Cost: $680

- Mecklenburg County Occupancy Tax (8%): $680 x 8% = $54.40

- Total Sales Tax (7.25%): $680 x 7.25% = $49.30

- Total Taxes (15.25%): $103.70

- Total Charges: $783.70

Airbnb automatically collects and remits both taxes and charges them to the guest. However, other platforms or direct bookings may not. Make sure to contact local authorities to find out if you need to collect and remit them.

Wrapping Things Up

By understanding the statewide requirements and the specific local taxes for your area, you can ensure you’re compliant and avoid any nasty surprises. North Carolina’s approach is quite host-friendly in that virtually 100% of the occupancy tax revenue is kept at the local level.

We always recommend checking in with your local government or a certified tax professional before starting a short-term rental in your area.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.