Back

The Complete Florida Airbnb Host Lodging Tax Guide: Airbnb Florida Occupancy Tax Breakdown

Written by:

Jeremy Werden

April 24, 2025

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

As a new or aspiring Airbnb host in Florida, understanding your tax obligations is crucial to running a successful and compliant short-term rental business. Florida’s tax landscape for vacation rentals can seem complex at first glance, but once broken down, it becomes much more manageable. This guide will help you be informed about the lodging and occupancy taxes that apply to your rentals in the Sunshine State.

State-wide Lodging and Occupancy Taxes in Florida

All short-term rentals are subject to the state sales tax and any local taxes on lodging. By law, Florida imposes a 6% state sales tax on transient rentals. The state defines a short-term rental as “Any individual lease agreement less than six months in duration” or “A housing accommodation rented for stays of 30 days or less, more than three times per year.”

In addition, each county may levy a discretionary sales surtax (0.5–1.5% depending on the county) on the same transactions. Finally, Florida law allows local option transient rental taxes, often called Tourist Development Tax, Convention Development Tax, Tourist Impact Tax, or Municipal Resort Tax, imposed by counties or cities on lodging. These local taxes are in addition to the 6% state tax and surtax.

Does Airbnb or VRBO Collect and Remit Taxes in Florida?

As of 2025, Airbnb has agreements to collect and remit taxes on behalf of hosts in certain Florida locations. However, these agreements vary by location, and hosts should not assume that Airbnb is handling all tax obligations. In many counties, hosts are still responsible for collecting and remitting taxes themselves.

For example, Collier County has agreements with both Airbnb and VRBO to collect and remit Tourist Development Tax on behalf of their hosts. However, Manatee County explicitly states that they do not have agreements with third-party platforms such as Airbnb, HomeAway, or VRBO, making it the host’s responsibility to collect and remit the 6% Tourist Tax to their office.

It’s essential to check with your specific county tax collector’s office to verify whether any collection agreements exist with booking platforms.

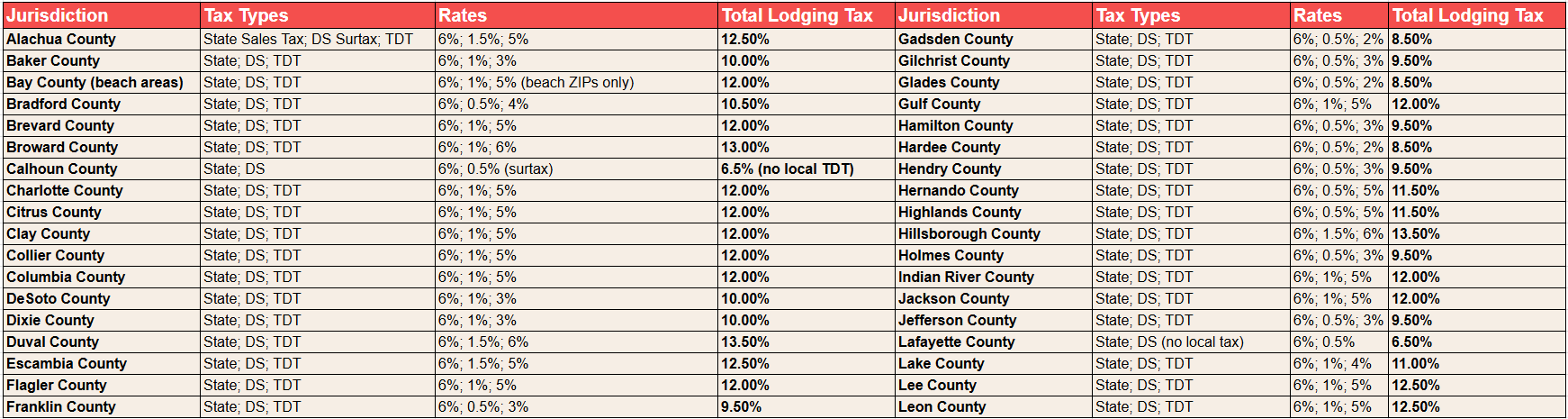

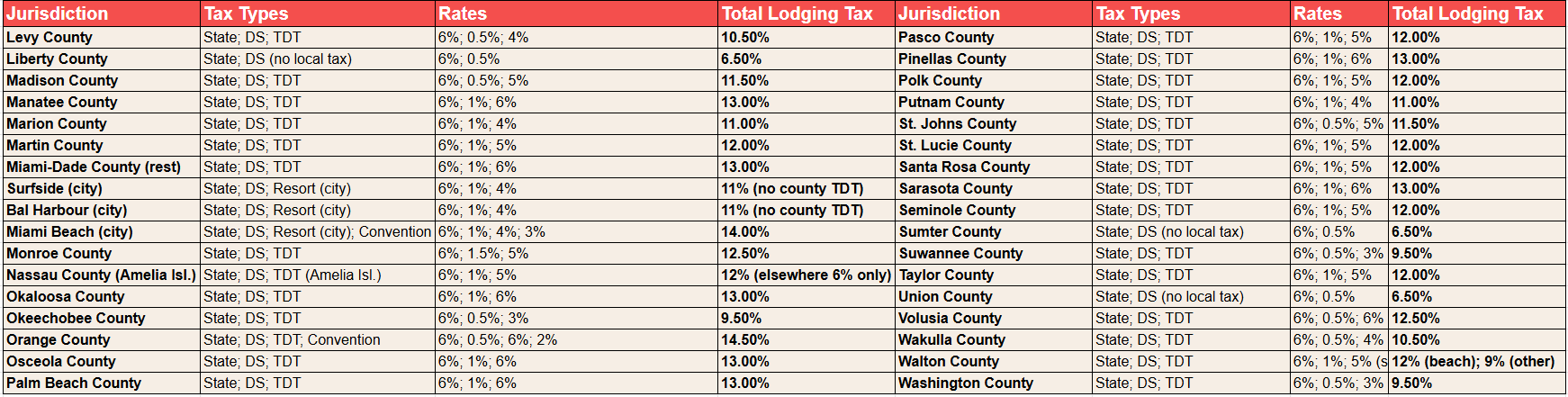

County-Specific Local Tax Requirements

In addition to the state sales tax, Florida counties can impose their own local option transient rental taxes, often called Tourist Development Taxes (TDT) or "bed taxes." These county taxes range from 0% to 6%, depending on the location.

Tourist Development Tax Breakdown

The Tourist Development Tax is authorized under Section 125.0104 of Florida Statutes. Counties may levy this tax at rates of 1% or 2% on transient rental transactions. The revenues are typically used for:

- Capital construction of tourist-related facilities

- Tourist promotion

- Beach and shoreline maintenance

Counties that have levied the initial tax for at least three years may impose an additional 1% tax for similar purposes.

NOTE:

- Bay: Applies only to ZIP codes 32401, 32404, 32405, 32407, 32408, 32410, and Bay County portion of 32413.

- Miami-Dade: rates vary by location: 4% for Surfside and Bal Harbour, 7% for Miami Beach, and 6% for the rest of the county

- Nassau: Applies only to Amelia Island (ZIP code 32034).

- Okaloosa: 6% for the Okaloosa County Tourist Development Tax District and 6% for the Expansion District.

- Walton: 5% for ZIP codes 32459, 32550, 32454, 32461, and Walton County portion of 32413; and 2% for the rest of the county

Example Calculation for a Property in Orlando

For example, Orlando (Orange County) must collect 6% state tax plus a 0.5% county surtax, 6% Tourist Development Tax, and 2% Convention Development Tax for a total of 14.5% on a short-term booking.

A 3-night stay at $130 per night:

- Total nightly Rate: $130 x 3 = $390

- Cleaning Fee: $45

- Total Listing Price for a 3-night stay: ($130 × 3) + $45 = $435

- Florida State Tax (6%): $435 x 0.06 = $26.1

- County Surtax (0.5%): $435 x 0.005 = $2.175

- Tourist Development Tax (6%): $435 x 0.06 = $26.1

- Convention Development Tax (2%): $435 x 0.05 = $8.7

- Total Tax Collected: $63.075

- Total Guest Payment: $435 + $63.075 = $498.075

Wrapping Things Up

Understanding and complying with Florida's lodging and occupancy tax requirements is an essential part of running a successful short-term rental business. While it can be confusing at first, local tax offices are generally helpful resources if you have questions, and many counties offer workshops specifically for short-term rental operators. Both of these resources can help you better understand your tax obligations.

These tax ranges are meant for general information purposes. Local counties and even cities can have more specific rates that only apply to them. For this reason, we still highly recommend checking out the local STR regulations in your area or contacting local officials for more information.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.