Back

The Complete Colorado Airbnb Host Lodging Tax Guide: Airbnb Colorado Occupancy Tax Breakdown

Written by:

Jeremy Werden

April 24, 2025

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

Managing lodging taxes can be overwhelming for new Airbnb hosts in Colorado. Whether you're launching your first listing or expanding your rental portfolio, understanding your tax responsibilities is essential for running a successful and compliant business. This guide talks about the key aspects of Colorado's lodging and occupancy taxes as of 2025, helping you navigate the requirements with confidence.

State-wide Lodging and Occupancy Taxes in Colorado

As a short-term rental host in Colorado, you're required to collect certain taxes from your guests. At the state level, this includes a 2.9% sales tax applied to the total listing price, which encompasses cleaning fees and other charges. However, tax obligations can vary depending on your property's location, as local jurisdictions may impose additional taxes. It's essential to familiarize yourself with both state and local tax requirements to ensure full compliance.

Does Airbnb or VRBO Collect and Remit Taxes in Colorado?

The good news for Colorado hosts is that Airbnb and Vrbo often handle lodging tax collection and payment in many areas. When guests book through these platforms, the applicable taxes are calculated and added to the reservation. The platforms then remit these taxes directly to the appropriate tax authorities on your behalf.

However, coverage varies by location, so it's important to verify whether your city or county is included. As a host, you're still responsible for understanding and knowing your local tax obligations, registering with the appropriate tax authorities, and collecting and remitting any taxes not handled by the platforms. In jurisdictions where Airbnb or Vrbo are required by law or have agreements to collect and remit taxes, hosts cannot opt out of this process.

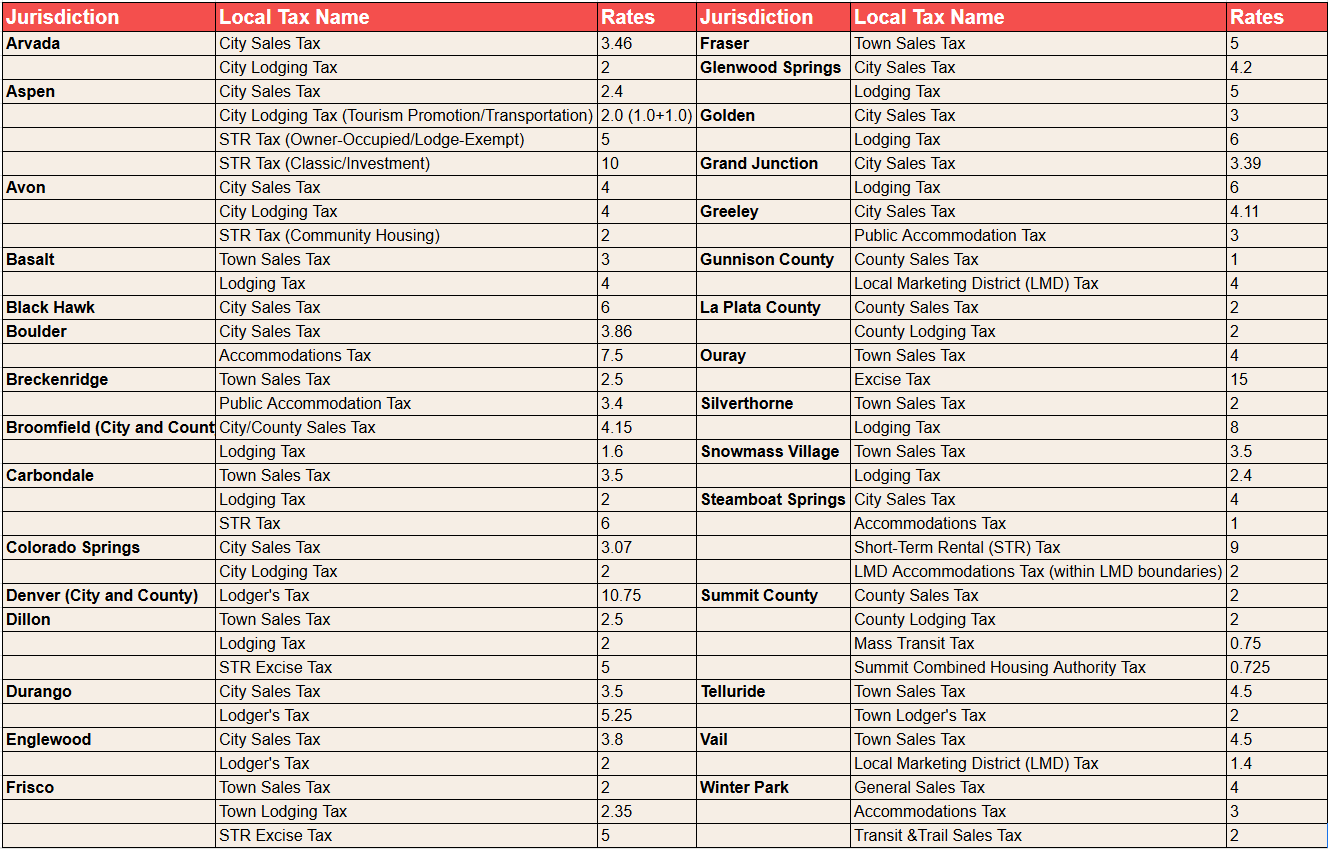

City and County-Specific Tax Requirements

Beyond the state sales tax of 2.9%, your short-term rental can be subject to additional local taxes depending on your specific location. These typically include:

- Local Sales Tax: Varies from 1% to 5% by city or county

- County Lodging Tax: Between 0.9% and 2%, depending on the county (with potential increases in some counties as of 2025)

- Local Marketing District Tax: Ranging from 1.4% to 4%

- Metropolitan District Tax: Usually between 0.5% and 5.5%, depending on the district

Example Calculation for a Property in The Town of Dillon

A 3-night stay at $130 per night:

- Total nightly Rate: $130 x 3 = $390

- Cleaning Fee: $45

- Total Listing Price for a 3-night stay: ($130 × 3) + $45 = $435

- Colorado State Sales Tax (2.9%): $435 x 0.029 = $12.615

- Town Sales Tax (2.5%): $435 x 0.025 = $10.875

- Lodging Tax (2%): $435 x 0.02 = $8.7

- STR Excise Tax (5%): $435 x 0.05 = $21.75

- Total Tax Collected: $53.94

- Total Guest Payment: $435 + $53.94= $488.94

Wrapping Things Up

By understanding and properly managing these tax obligations, hosts can avoid costly penalties while remaining compliant in running a successful Airbnb business.

These tax ranges are meant for general information purposes. Local counties and even cities can have more specific rates that only apply to them. For this reason, we still highly recommend checking out the local STR regulations in your area or contacting local officials for more information.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.