Back

The Complete California Airbnb Host Lodging Tax Guide: Airbnb California Occupancy Tax Breakdown

Written by:

Jeremy Werden

April 24, 2025

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

Entering the short-term rental market in California is exciting, but it also comes with plenty of lodging and occupancy tax rules. Whether you’re a new or aspiring Airbnb host, understanding your tax obligations is essential for running a successful and compliant Airbnb business. Here’s a comprehensive, up-to-date guide to help you navigate California’s lodging and occupancy tax landscape as of 2025.

State-wide Lodging and Occupancy Taxes in California

Unlike most states, California does not currently have a statewide lodging tax that applies uniformly across all jurisdictions. Instead, the authority to levy Transient Occupancy Tax (TOT), also commonly known as “bed tax” or “hotel tax,” is granted to cities and counties by California Revenue and Taxation Code 7280. This means your tax obligations will depend entirely on where your property is located.

However, it’s important to note that there has been a legislative movement that has already been proposed back in 2023, so it’s not impossible to have a statewide Transient Occupancy Tax in the future.

Senate Bill 584, known as the Laborforce Housing Financing Act, proposed a 15% tax on short-term rentals statewide, which would be in addition to local TOT rates. This bill would’ve begun on January 1, 2025, and would’ve applied to short-term rentals defined as occupancy of a home, house, room, or other lodging that is not a hotel, inn, motel, or bed and breakfast for a period of 30 days or less.

As of 2025, legislative records indicate that SB 584 was withdrawn by the author, did not pass through the legislative process, and is considered inactive or “dead.” Again, while this specific bill did not pass, future ones could be proposed. Hosts should stay informed about any developments regarding California-wide Transient Occupancy Taxes.

Does Airbnb or VRBO Collect and Remit Taxes in California?

Airbnb and VRBO have agreements with many cities and counties in California to automatically collect and remit local occupancy taxes on behalf of hosts. However, this is not universal as some jurisdictions require hosts to register, collect, and remit taxes themselves or to opt-in to platform collection for certain assessments.

Always check your local tax collector’s website or contact them directly to confirm your obligations.

City and County-Specific Tax Requirements

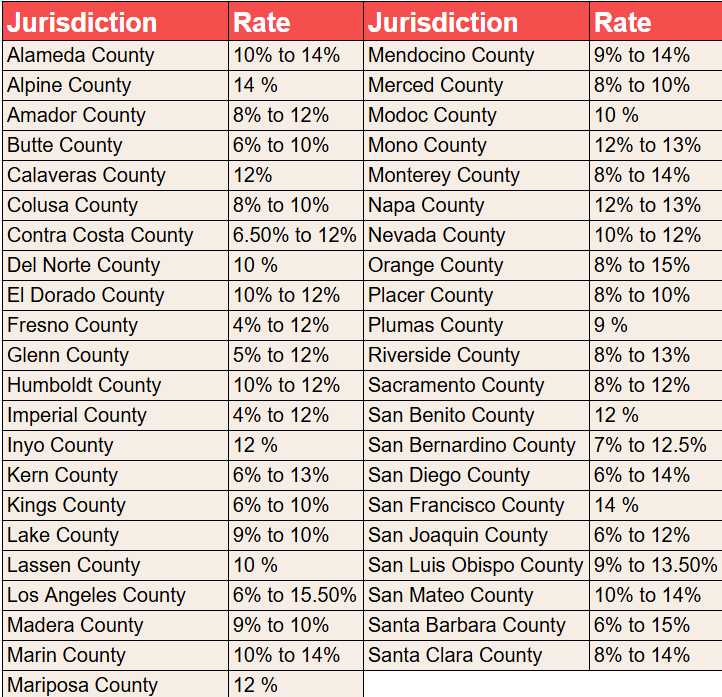

California’s cities and counties each set their own lodging and occupancy tax rates, and many layer on additional tourism or business improvement assessments. So, buckle up as we’re going to discuss every Transient Occupancy Tax rate in California.

Example Calculation for a Property in Los Angeles City

A 5-night stay at $150 per night:

- Total nightly Rate: $150 x 5 = $750

- Cleaning Fee: $100

- Total Listing Price for a 5-night stay: ($150 ×5) + $150 = $850

- TOT Collected (14%): $850.00 x 0.14 = $119.00

- Total Tax Collected by Airbnb: $119.00

- Total Guest Payment: $850.00 + $119.00 = $969.00

Wrapping Things Up

As your business grows, consider consulting with a tax professional who specializes in short-term rentals to ensure you’re meeting all your obligations. With proper tax compliance, you can focus on what matters most, providing an excellent experience for your guests and building a thriving hosting business in California.

These tax ranges are just general estimates based on the average rates per state. Local counties and even cities can have more specific rates that only apply to them. For this reason, we still highly recommend checking out the local STR regulations in your area or contacting local officials for more information.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.