Back

Should You Short-Term or Long-Term Rent Your Property?

Written by:

Jeremy Werden

July 10, 2025

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

Whether you’re a first-time rental investor or a seasoned pro, every new property brings you to the same crossroads: Should you list it on Airbnb or go with a long-term tenant? This decision can make or break your investment.

Deciding between short-term and long-term rentals is one of the most important choices property owners face in today’s competitive real estate market.

While factors like your property’s location, your available time, and local regulations all play crucial roles in determining which path leads to success. Some markets heavily favor vacation rentals, while others make traditional leasing the clear winner.

So today, we’ll discuss how we use BNBCalc to analyze our potential rental properties and figure out which path to take.

What Are Short-Term and Long-Term Rentals?

Understanding the difference between short-term and long-term rentals is essential for any property owner looking to optimize their investment.

Short-term rentals, often referred to as vacation rentals or Airbnb-style properties, are typically leased for a couple of days at a time. These rentals cater to tourists, business travelers, or anyone seeking temporary accommodation, and are especially strong in popular vacation destinations like near beaches, tourist hotspots, and others.

On the other hand, long-term rentals, or traditional rentals, are generally defined through leases lasting six months or more, often a year if not longer. These arrangements are most common in residential markets where tenants seek stable, affordable housing.

Long-term rentals provide property owners with predictable monthly income through traditional lease agreements that clearly define tenant and landlord responsibilities. Overall, long-term rentals can be simpler to manage since everything is under contract and has a less hospitality-focused approach.

Key Differences Between Short-Term Renting and Long-Term Renting

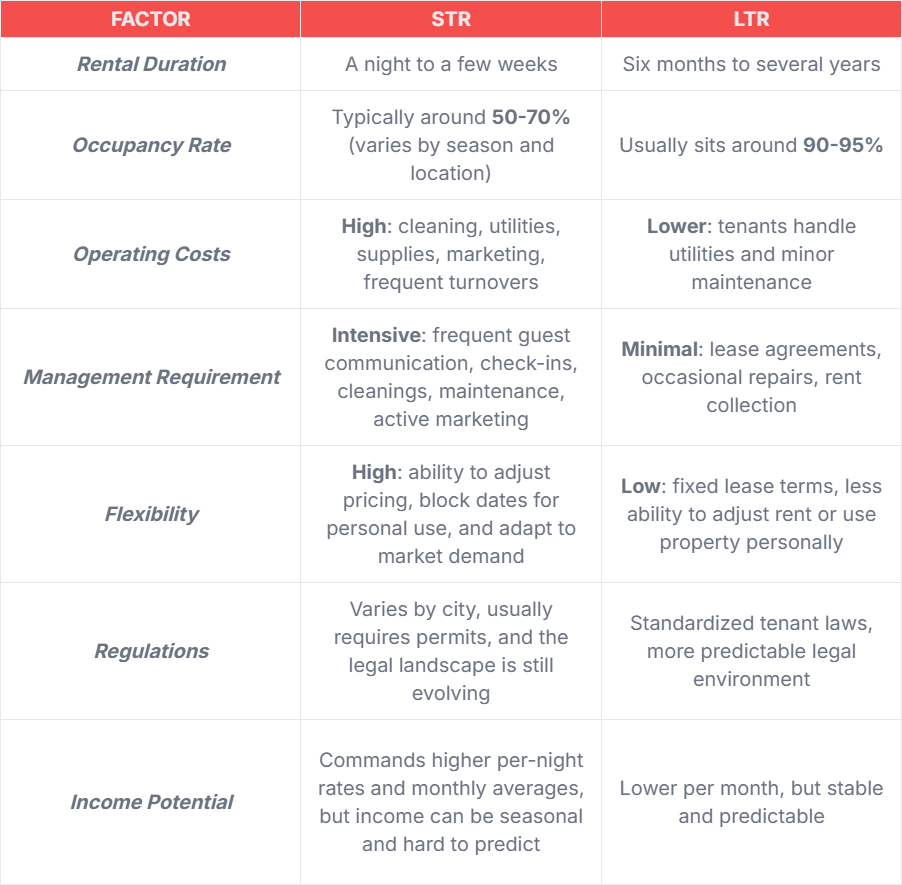

Understanding the key differences between short-term and long-term rentals is crucial when deciding which path to take. While both strategies can definitely be profitable, they come with distinct operational realities, financial outcomes, and responsibilities.d

Short-term rentals offer the potential for higher annual income, thanks to premium nightly rates and flexibility in pricing and property use. However, this strategy demands active management, including frequent guest communication, turnovers, and higher operating costs for cleaning and utilities. Income can be inconsistent due to seasonality and fluctuating demand. Additionally, short-term rentals are often subject to strict and changing local regulations, which may require permits or limit rental days, adding another layer of complexity for property owners.

In terms of expenses, owners are generally liable to pay for everything regarding the property. This includes everything from utilities to insurance, cleaning, maintenance, repairs, and renovations. However, some hosts do opt to charge guests cleaning fees on top of the total accommodation rate.

Long-term rentals provide property owners with steady, predictable income and high occupancy rates, often exceeding 90%. The management workload is lighter, as tenants typically handle day-to-day cleaning and maintenance, and lease agreements reduce the need for constant marketing or guest turnover. The regulatory environment is more stable, governed by established landlord-tenant laws. However, this approach lacks flexibility since lease terms are fixed, which makes it difficult to adjust rent or use the property personally. While monthly returns may be lower, the reduced vacancy risk makes long-term rentals a popular choice for more conservative investors.

Most of the expenses, such as utilities (internet, phone, electricity, water, etc) and minor maintenance, are typically passed on to the tenants. Only major repairs and renovations are usually shouldered by the owner. However, these are still negotiable and dependent on the terms agreed upon by both parties.

The choice between these two rental strategies depends on your property’s location, local regulations, and your personal goals as an investor. Short-term rentals can deliver higher nightly rates and greater flexibility, but require more active management and marketing. Long-term rentals offer stability and predictability, but may yield lower overall returns compared to peak short-term rental seasons. Understanding these definitions and distinctions is the first step in choosing the right rental strategy for your property.

Short-Term Rental Pros and Cons

Here are a couple of pros and cons for short-term rentals:

Pros

- Offers great flexibility

- The ability to use the property for personal stays during unbooked stretches

- Can adjust pricing based on demand and seasonality

- Potential for higher revenue, especially during peak seasons or holidays

- Caters to a diverse range of guests, including families, couples, individuals, and business travelers, among others

Cons

- Can require more hands-on management and maintenance effort due to quick turnarounds

- You might need to hire a property manager to coordinate guest turnovers, check-ins, check-outs, cleaning, etc

- Typically has stricter regulations and restrictions (depending on the location)

- Occupancy rates can be unpredictable and more volatile compared to traditional rentals

Long-Term Rental Pros and Cons

Here are a couple of pros and cons for long-term rentals:

Pros

- Offers great stability and predictable income

- Reduced management demands and offers a more hands-off approach

- Fewer regulations and restrictions, with most locations having well-established long-term laws (depending on the location)

- Fewer daily maintenance requirements

Cons

- Overall lower returns than STRs, especially when in tourist hotspots

- Tenant issues can arise, which is why thorough screening is essential

- Offers less flexibility and can’t be used for personal stays

- Cannot adjust pricing mid-lease (unless stated in the contract)

- Required to honor contract duration

Comparing Short-Term and Long-Term Rental Revenue with BNBCalc

While there are definitely other factors in play, most investors will figure things out and boil it down to one critical factor: “Which strategy will generate the most revenue for your property?”

This is where tools like BNBCalc become incredibly helpful for property owners and investors. Through some recent updates, BNBCalc now allows users to analyze both short-term and long-term rental projections side-by-side, using real-world data and customizable inputs to help you make informed, data-driven decisions.

This is one of the ways we utilize the platform’s revenue projections to help us make informed decisions when finding a new investment property. On BNBCalc, you simply enter your property’s address and enter details such as purchase price, number of bedrooms, bathrooms, and number of guests.

It will then create an analysis that contains revenue projections for both short-term and long-term rental scenarios. BNBCalc uses historical data based on nearby comparables and how they perform to create the initial projection. There’s a simple button you can use to switch between an STR analysis and an LTR analysis for easy comparisons.

BNBCalc also lets you adjust variables like occupancy rates, nightly rates, and operating expenses, so you can test different scenarios and see how the changes impact your bottom line. This flexibility helps you tailor your rental strategy to your investment goals and get a better overall picture of your potential investment.

Short-Term Rental Vs Long-Term Rental Analysis with BNBCalc

To help you get a better understanding of how we use BNBCalc to make STR vs LTR investment decisions, here’s an example analysis of some active Zillow listings.

Example 1: Isle of Palms Waterfront Property

The first property is a 4-bed, 3-bath, 1743 sqft property located somewhere in the Isle of Palms. It has a deepwater dock with a large floater, multiple porches, and a refinished deck for a solid waterfront experience. It can comfortably sleep 8-12 persons with a large loft, a second living room, and abundant windows to let that nice breeze in.

From the description alone, some veteran investors can probably already tell that this can make for a great short-term rental property. Let’s run the address through BNBCalc to see some data.

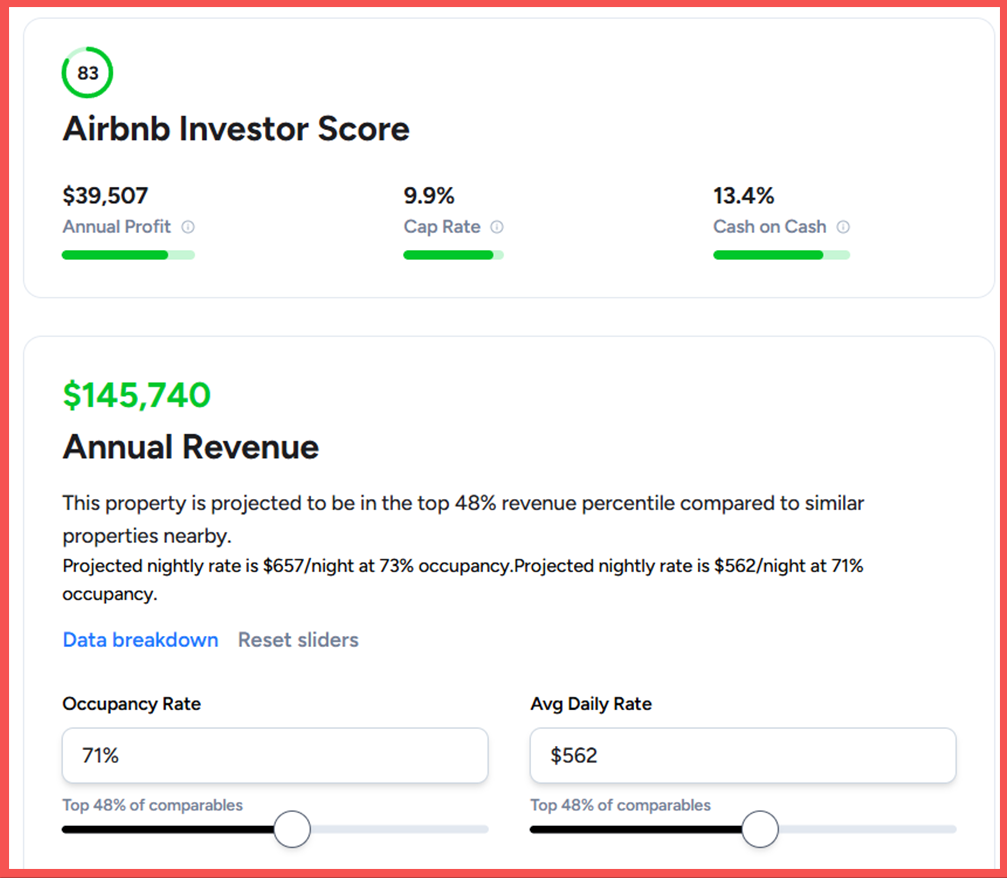

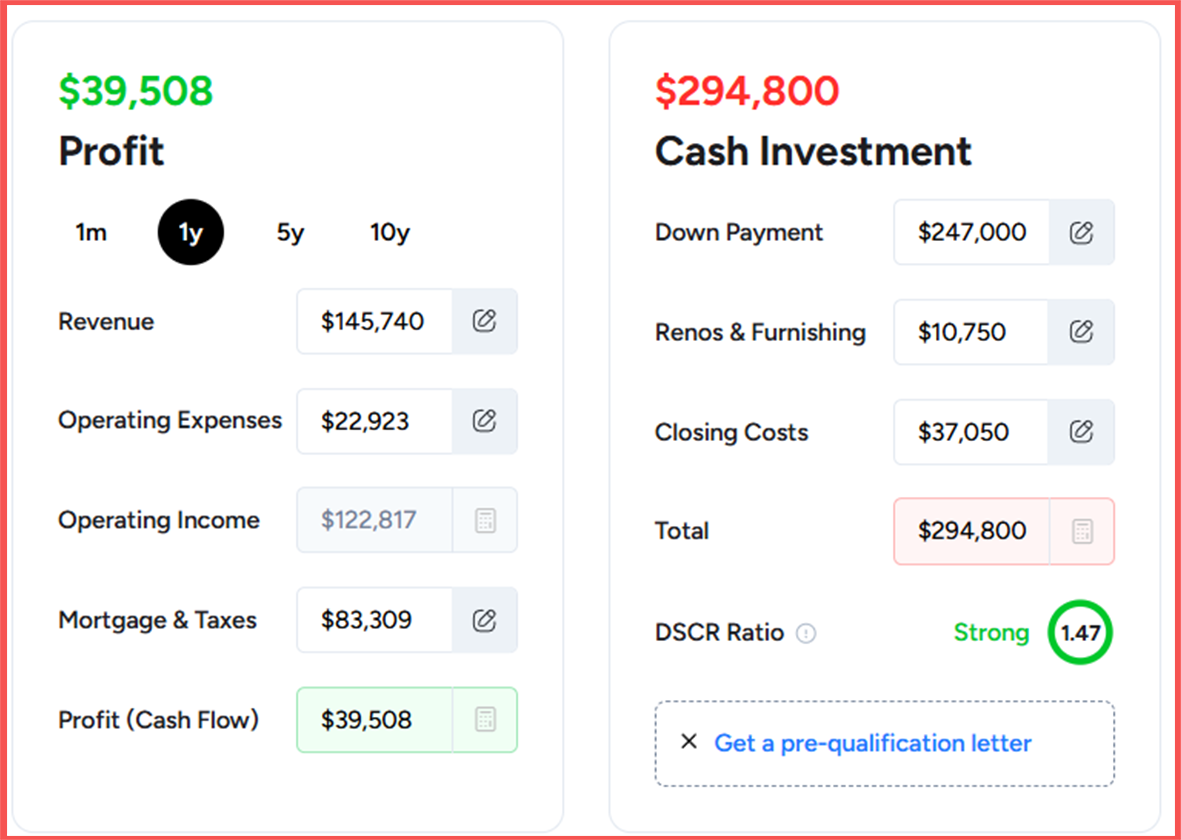

Based on the analysis, the base projections for the property include a 71% occupancy rate with a $562 ADR and great seasonality. This results in a projected annual revenue of $145K and about $39K in annual profit as an STR.

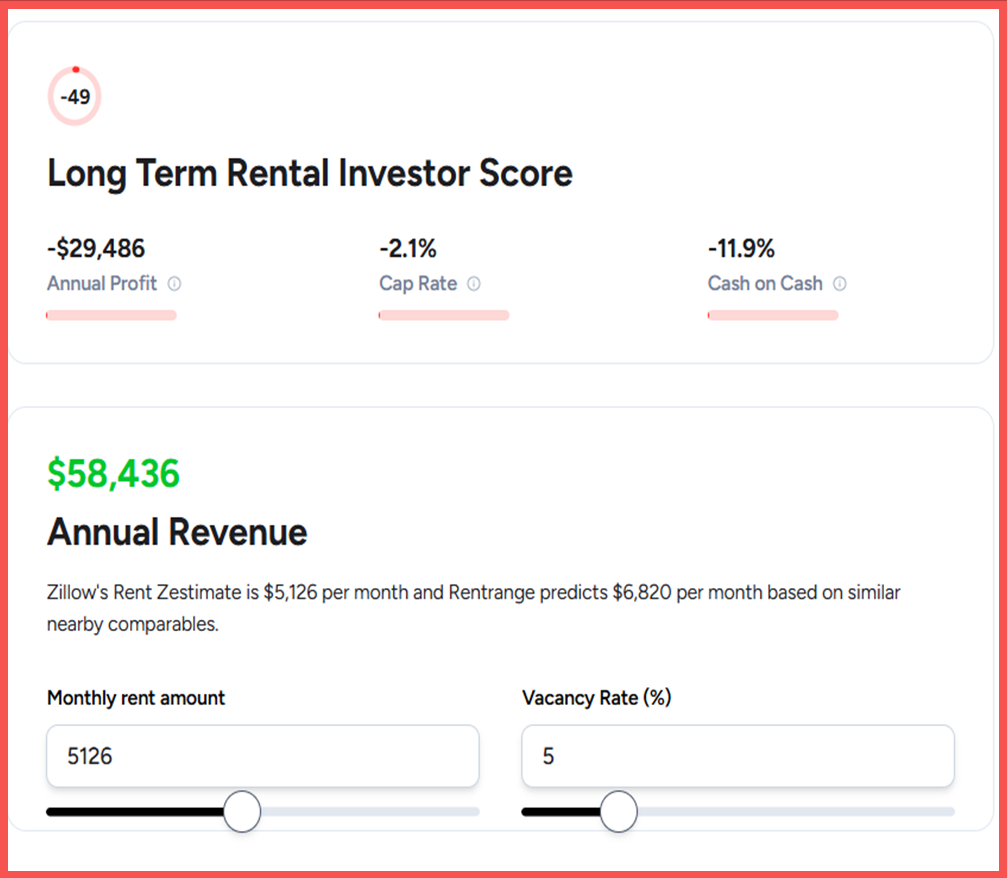

Switching over to the long-term rental analysis of the same property yields vastly different results.

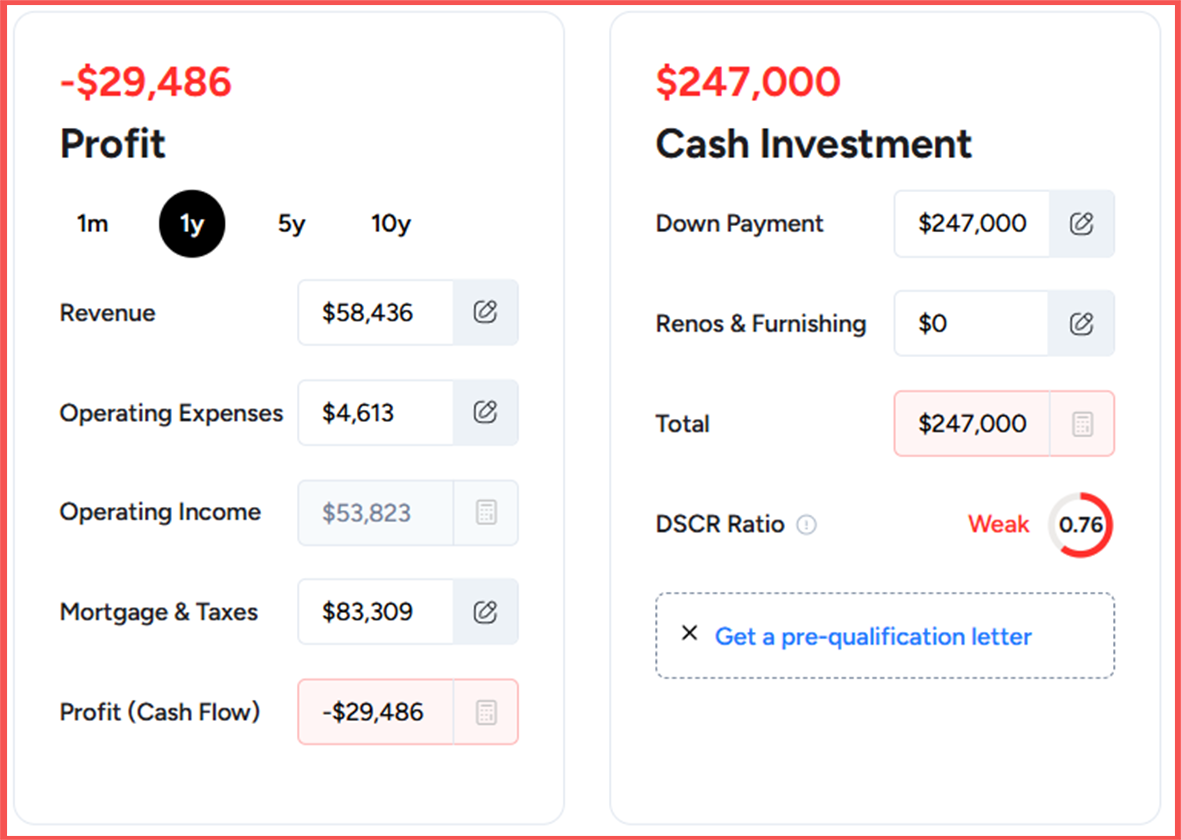

Since it’s a waterfront property with 4 beds, monthly rent prices are estimated to be around $5126 with a reasonable 5% vacancy rate. While the revenue looks decent at first glance, the expenses and mortgage payments add up and quickly turn the LTR profits for the property into the red. It’s projected to net a -$29K annual loss, which means you’ll be losing money if you choose to go the traditional rental route.

Based on this data, this property is likely going to do much better as a short-term rental than a long-term rental investment in terms of pure revenue.

Example 2: Atlanta Urban Home

The next property is a 3-bed, 2-bath, 1887 sqft home in Atlanta. It features a blend of classic architecture with modern designs. It’s right in the heart of the city, being only a short walk to Grant Park, Downtown Atlanta, and GSU.

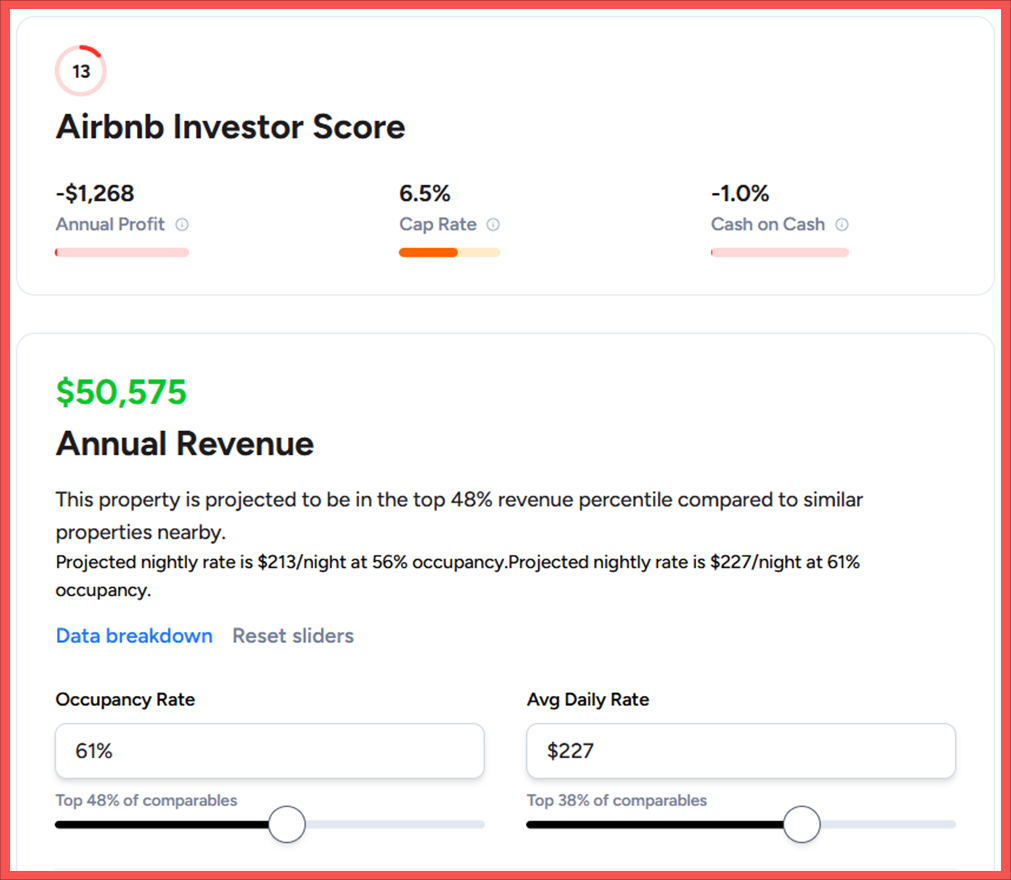

In just a quick glance at the analysis, buying the property as a short-term rental investment already doesn’t look good. BNBCalc projects the property to net a -$1268 in annual losses. Overall, while the ADR and occupancy rates you can get are fairly decent, they just aren’t enough to sustain the costs and expenses associated with the property.

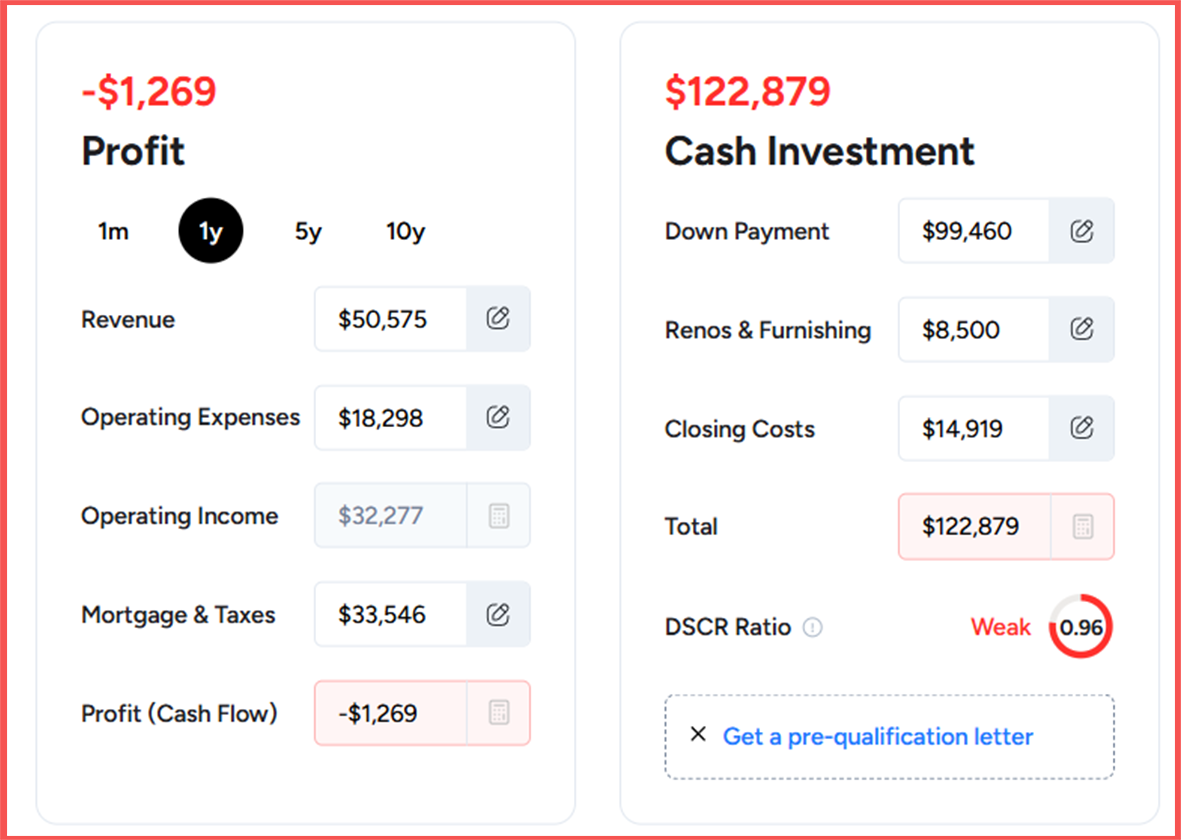

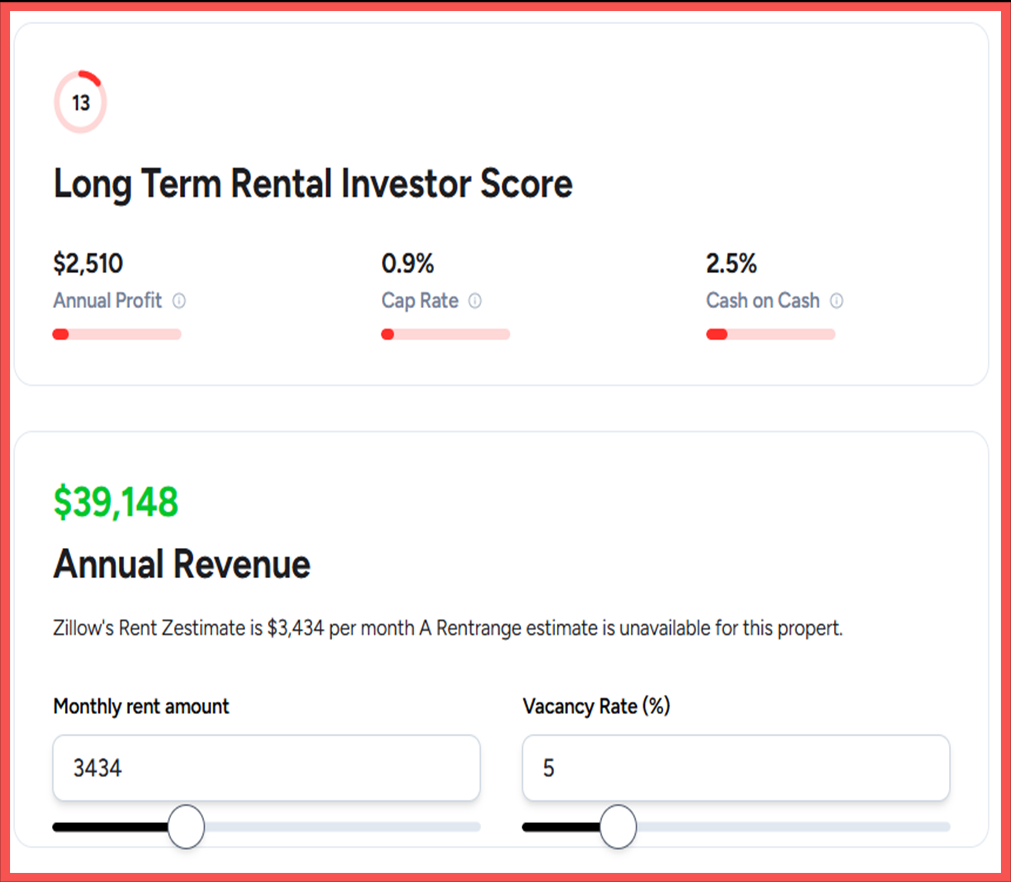

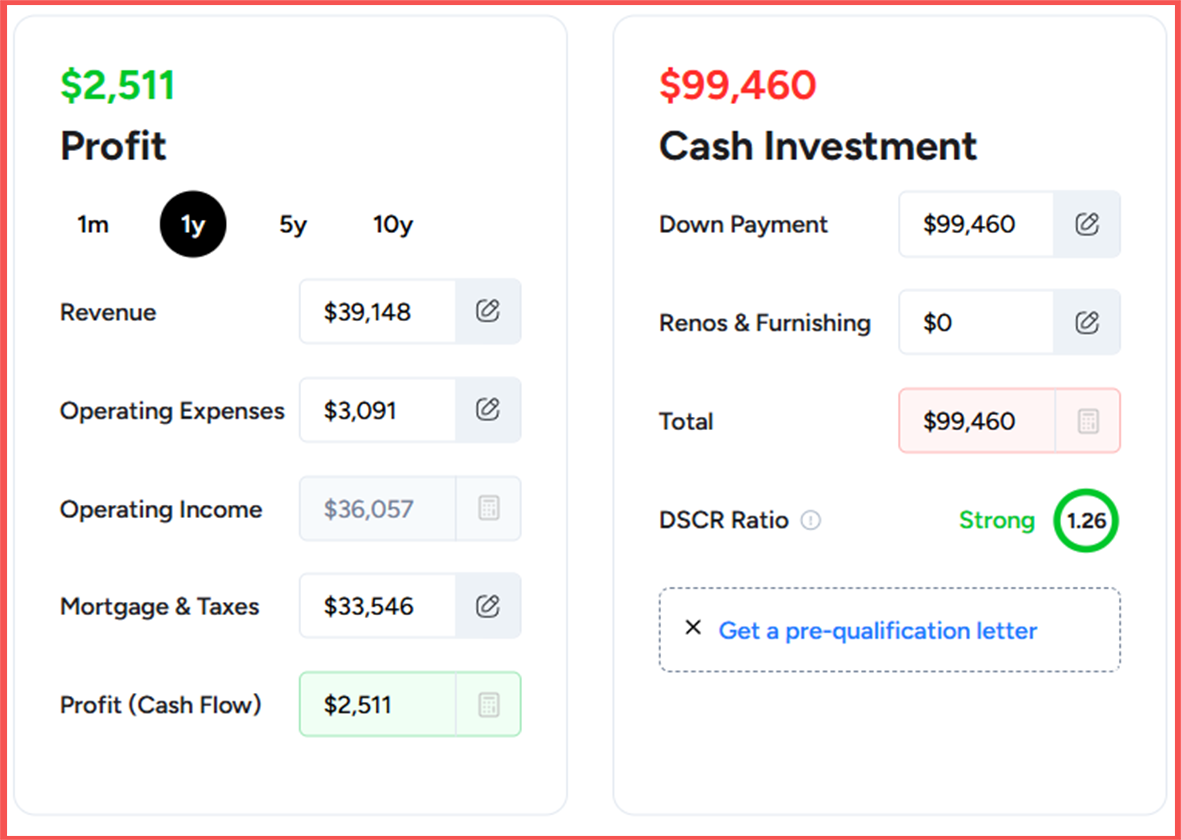

The grass is looking a little greener when looking over to the long-term rental side, albeit not by much. You can expect to charge around $3434 in monthly rents with a 5% vacancy rate as an LTR. This results in a $2510 annual profit. While it’s not much, at least you’re not losing money on the property.

Based on this data, this property is probably better off as an LTR than an STR. However, due to the low revenue, regardless of rental type, it might not be the best investment property to purchase.

Wrapping Things Up

Deciding between short-term and long-term rentals can feel overwhelming, but it doesn’t have to be. There are many factors that should contribute to your decision. Your property type, location, personal goals, local market dynamics, and more should all be considered when making the important STR vs LTR decision.

However, using a tool like BNBCalc can help make the decision easier. You can compare revenue projections side-by-side and make data-driven choices that maximize the returns on your investment. The smart move is researching your specific market and running the calculations before making any commitments. At the end of the day, there’s no one-size-fits-all answer, so take time to understand what works best for your situation and goals.

Disclaimer: Both properties we presented are real addresses that have been entered into BNBCalc. These provided analyses are only meant as examples to educate and help inform potential investors. BNBCalc makes no warranties regarding the real-world accuracy of the metrics provided. They aren’t and shouldn’t be treated as financial or investment advice. BNBCalc takes no responsibility for any investment or financial decisions made using the data presented above. Always conduct your own due diligence and consult qualified professionals before making investment decisions.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.